RiG Extreme value theory

08052850 · RiG Extreme value theory

Lecturer: Prof. Dr. Markus Bibinger

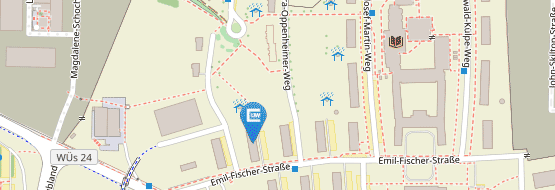

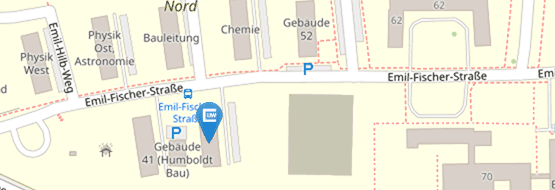

- Date and location: There are lectures each Tuesday, 12:15-13:45, in Raum 00.103 (Bibl- u Seminarzentrum).

- Start: 18.10.2022, 12:15, in Raum 00.103 (Bibl- u Seminarzentrum)

- Exams: Oral exam after the end of the course and project work

- Language: German or English, English lecture notes

Contents of the lecture:

We introduce univariate, probabilistic extreme value theory. This field is devoted to the asymptotic behaviour of extremes (including maxima and minima), in particular their asymptotic distributions. Important aspects of the lecture are extreme value distributions, the theorem of Fisher-Tippett-Gnedenko, domain of attractions, excesses and generalized Pareto distribution, peaks over threshold and order statistics. Methods for statistical inference will be developed. Extreme value theory and extreme value statistics enable us to consider first applications to financial data and climate data to perform risk management. Most importantly, we can estimate extreme quantiles which cannot be estimated based on empirical quantiles.

Literature:

- Skript von Zakhar Kabluchko (German)

- Skript von Matthias Löwe (German)

- Laurens de Haan & Ana Ferreira: Extreme value theory. An introduction, Springer Series in Operations Research and Financial Engineering. Springer, New York, 2006. Link

- Michael Falk, Rolf-Dieter Reiss und Jürg Hüsler: Laws of Small Numbers: Extremes and Rare Events. Birkhäuser 2011. Link

- Paul Embrechts, Claudia Klüppelberg und Thomas Mikosch: Modelling Extremal Events for Insurance and Finance. Springer, 1997

Notes:

(1) Registration (Vst.-Nr. 08052850) in WueStudy is required.

(2) Materials (lecture notes etc.) via WueCampus link