Talks

- Valuation in the structural model of financial networks

- Research Seminar of the Oesterreichische Nationalbank (OeNB), May 8, 2015, pdf

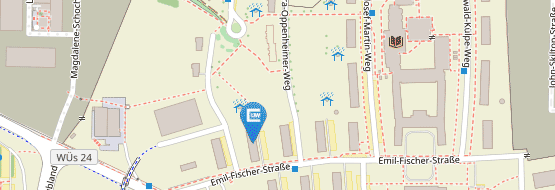

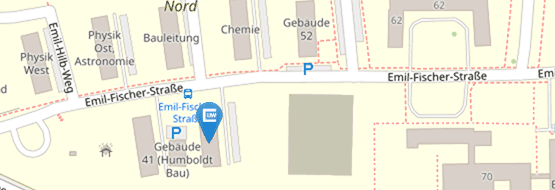

- Frankfurt MathFinance Colloquium -- Frankfurt MathFinance Institute, November 27, 2014, pdf, photo (foreground: Christoph Kühn; background: Tom Fischer; photographer: Dirk Müller)

Original title: Valuation in the structural model of systemic interconnectedness

- No-arbitrage pricing under systemic risk: accounting for cross-ownership

- 10th German Probability and Statistics Days 2012 - Stochastik-Tage Mainz, Mainz, March 6-9, 2012

- Scientific Conference of the German Association for Actuarial and Financial Mathematics (DGVFM), Bremen, April 30, 2010

- Finanz- und Versicherungsmathematik: Einblicke & Beispiele

- Mathematiker besuchen Ihre Schule, Bayernkolleg Schweinfurt, Schweinfurt, May 22, 2012, pdf

- Tag der Mathematik, University of Würzburg, Würzburg, November 6, 2010

- From fair risk contributions to fair premiums

- First Buea Conference on the Mathematical Sciences, Buea (Cameroon), May 14, 2009

- Students' Actuarial Society Conference, Edinburgh, February 25, 2009

- Consumption processes and positively homogeneous projection properties

- Cass Business School (City University), London, March 12, 2008

- Bachelier Finance Society, Fourth World Congress, Tokyo, August 17-20, 2006

- Frankfurter Stochastik-Tage 2006, Goethe-Universität, Frankfurt am Main, March 14-17, 2006

- Alternative Consumption Strategies and Their Actuarial Applications

- Presentation at the Workshop for Young Mathematicians by the Deutsche Aktuar-Akademie, Reisensburg, September 21-22, 2007

- Project Presentation: Consumption Processes with Local Properties

- Faculty and Institute of Actuaries, Staple Inn, London, March 19, 2007

- Differentiability of Risk Measures: Applications, Problems, Remedies

- Workshop "Risk Measures & Risk Management General Aspects", EURANDOM, Eindhoven, May 9-11, 2005

- On the decomposition of risk in life insurance

- Workshop on the Interface between Quantitative Finance and Insurance, ICMS, Edinburgh, 4-8 April 2005

- 8th International Congress on Insurance: Mathematics and Economics, University Luiss Guido Carli, Rome, June 14-16, 2004

- Risk and performance optimization for portfolios of bonds and stocks

- Karlsruher Stochastik-Tage 2004, Karlsruhe University, March 23-26, 2004

- Presentation at the European Central Bank (ECB) Frankfurt, February 13, 2004

- An axiomatic approach to valuation in life insurance

- Vienna University of Technology, Financial and Actuarial Mathematics Group, November 28, 2003

- London School of Economics, Department of Statistics, October 17, 2003

- 7th International Congress on Insurance: Mathematics and Economics hosted by I.S.F.A. in Lyon, June 25-27, 2003

- Risk Capital Allocation by Coherent Risk Measures Based on One-Sided Moments

- 6th Conference of the Swiss Society for Financial Market Research, Zürich / Rüschlikon, SwissRe Centre for Global Dialogue, April 4, 2003

- 6th International Congress on Insurance: Mathematics and Economics hosted by CEMAPRE, ISEG, in Lisbon, July 15-17, 2002

- Kohärente Risikomaße und ihre Anwendung in Versicherungsunternehmen

- 47. Tagung der ASTIN-Gruppe der Deutschen Aktuarvereinigung e.V. (DAV), Hamburg, 15. November 2002

- Simulation of the Yield Curve: Checking a Cox-Ingersoll-Ross Model

- BMBF-Workshop "Energie- und Finanzwirtschaft", ZIB, 04.-05.03.2002

- Joint seminar "Mathematical Finance" of the University of Bonn and the research center "caesar", Bonn, February 21, 2002

- Examples of Coherent Risk Measures Depending on One-Sided Moments

- Ph.D.-student workshop "Financial Mathematics and Statistics" at "caesar", Bonn, November 29-30, 2001

- Differentiability of coherent risk measures

- Lunchtime Seminar on Financial and Insurance Mathematics at ETH Zürich, July 4, 2001

- Eine Methode zur Modellierung stochastischer Abhängigkeit von Ausfallereignissen in Kreditportfolios

- Doktorandenseminar des Alfred-Weber-Instituts, Universität Heidelberg, 8. Mai 2001